The Bank of Canada (BoC) cut its key interest rate today by 0.25% to 4.25%. This is the third of potentially five cuts this year.

The Bank’s decision reflects two main developments:

- Inflation continues to ease as expected.

- As inflation decreases, the BoC wants to see economic growth pick up to absorb the slack in the economy. I.E., growth is lower than it could be.

Overall, the economy’s weakness continues to pull inflation down.Tiff Macklem (the BoC governor) said today, “If inflation continues to ease broadly in line with the central bank’s July forecast, it is reasonable to expect further cuts in the policy rate. We will continue to assess the opposing forces on inflation and take our monetary policy decisions one at a time.”

This Friday’s Labour Force Survey data for August is very important; we expect economic activity to slow from the 2.1% growth in Q2, which was slightly above expectations. However, the incredible growth in Canada’s population has done little for our competitiveness and GDP per capita. Canada currently has the lowest GDP per capita in all of the G7 nations.

The concern here is that the Canadian population grew by 3.2% but the economy only grew by 2.1% last quarter, and 1.8% in Q1. This means that more people are adding less, per capita, to the economy… Additionally, the unemployment rate had risen over the past year to 6.4%, with the rise being concentrated in youth and newcomers to Canada, who find it more challenging to get a job. Business layoffs are moderate but hiring has been weak…

The Bottom Line

Monetary policy remains restrictive. While the target overnight rate is now 4.25%, core inflation is only roughly 2.4%. Real interest rates remain too high for the economy to reach its potential growth pace of about 2.5%. Weaker growth implies a continued rise in unemployment and excess supply in other sectors.

In separate news, the US released data showing that US job openings fell to their lowest level since January 2021, consistent with other signs of slowing demand for workers. US job growth has been slowing, unemployment is rising, and job seekers are having greater difficulty finding work, fueling fears about a potential recession.

Federal Reserve policymakers have made it clear they don’t want to see further cooling in the labour market and are widely expected to start lowering interest rates at their next meeting in two weeks.

In other news, consistent with a global economic slowdown, oil prices have plunged to new 2024 lows. Weak oil prices are a harbinger of lower inflation, growth and mortgage rates.

Bonds rallied (increased in price due to higher demand; remember, as bond prices increase, bond yields – rates – decrease) in the wake of the disappointing US data, taking the 5-year government of Canada bond yield down to a mere 2.89%, well below the 3.4% level posted when the Bank of Canada began cutting interest rates in June. This decline in market-driven interest rates reduces fixed-rate mortgage yields/rates. Moreover, today’s cut in the overnight rate will be followed soon by a 25 basis point reduction in the prime rate to 6.45%, reducing floating rate mortgage yields as well.

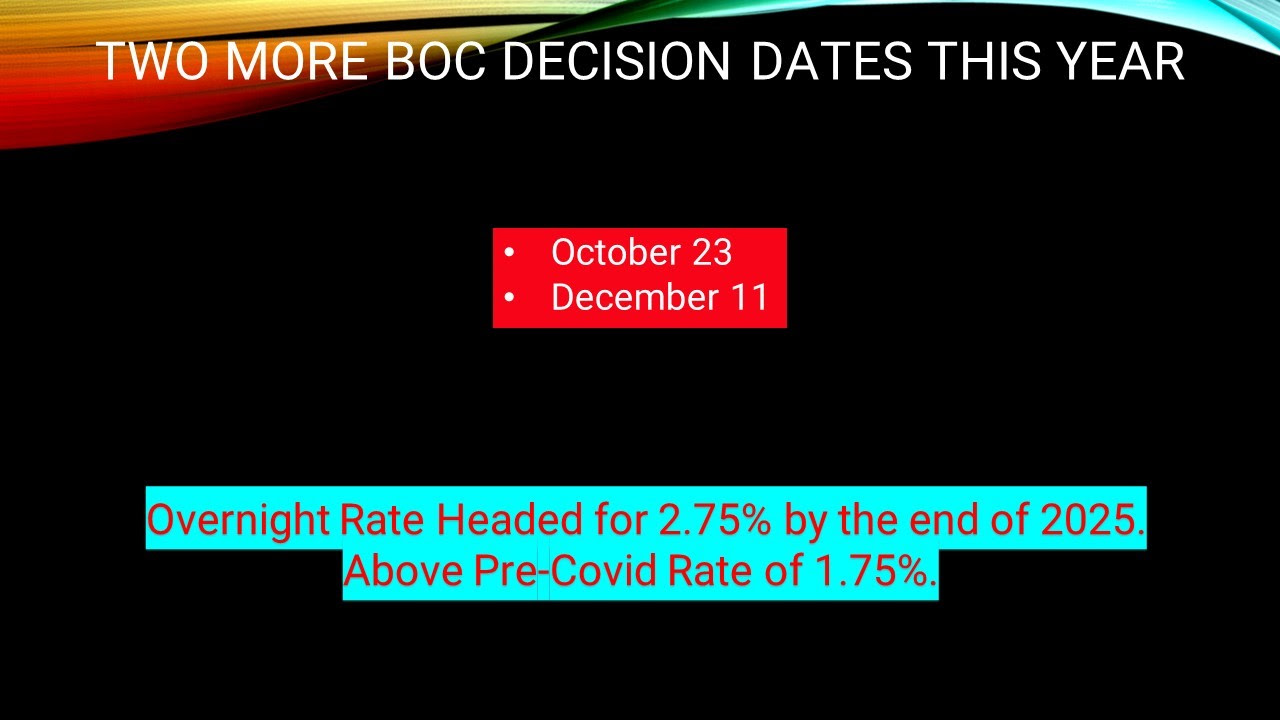

The Bank of Canada has two more decision dates this year: October 23 and December 11. At those meetings, the Bank is widely expected to continue its quarter-point rate cuts, taking the overnight rate down to 3.75% at year-end and 2.75% next year.